Northeastern PE/VC’s Venture Team: a group of highly passionate PE/VC members providing top-tier strategic advisory to the venture ecosystem

Northeastern Growth Partners

What We Do:

Our Venture Team is a versatile advisory group offering support to participants in the venture ecosystem: investors and startups. From initially offering strategic advisory to pre-seed to Series A startups, we now focus on supporting our network of early-stage investors source and learn about today’s new-age startups by assisting their deal flow. If you are pre-seed or seed stage startup, we can facilitate a warm introduction and present an investment pitch to our investor base!

Outsourced Deal Flow

Strategic Advisory

Formerly, NGP offered comprehensive strategic advisory to early-stage startups to enter new markets, discover ideal pricing models, and further develop their product suite.

We support a wide-range of multi-stage industry-agnostic investor clients by sourcing and facilitating warm introductions with superstar early-stage startups.

Slate Milk

-

Featured on Shark Tank, Slate is an ~$80M EV beverages e-commerce platform intended to provide all-natural, high-protein food and drinks with no added sugar. The company's platform sells chocolate milk that contains less sugar, more protein and no artificial colouring with no gluten, nuts, lactose, soy and carrageenan, enabling customers to enjoy flavoured milk which is beneficial for their health.

-

Eshan Gupta, Chloe Conroy, Aurrel Bhatia, Jonathan Meehan, Tiffany Zhou

-

Identifying unique Go-To-Market strategies and key suggesting implementation actions

-

Provided Slate Milk a comprehensive insight into i) university cafeteria, ii) university athletic clubs, iii) gym vending machines, and iv) corporate food service distribution channels and facilitated initial touchpoints for sales

Overview of tangible entry avenues for Quill Payments’ Boston entry

Featured Clients

We are working with leading venture investment funds Primary, Glasswing, Moneta, and Upfront Ventures for Fall 2025. Please review their investment thesis if you are considering raising from them.

-

Techrupt Innovations is a venture‑studio and startup‑builder (“enabling tomorrow’s unicorns”) that not only invests, but co‑builds companies. It is headquartered online/operationally in the US (and India) and has backed/built 15+ ventures.

-

Techrupt focuses on founding or backing early‑stage ventures (from MVP to growth) in sectors such as Ed‑Tech, B2B SaaS, AI tooling and direct‑to‑consumer brands. It partners with veteran leaders, provides product/tech/growth support, and typically collaborates with startup teams driving fast scale from zero.

Martinson Ventures

-

Martinson Ventures is a growth‑equity/venture capital firm headquartered in Newtown (PA), USA. It has backed more than 50 companies and typically invests initial checks between US$0.25 m and US$3.5 m.

-

Martinson focuses on entrepreneurial software‑driven companies primarily in the Mid‑Atlantic region (PA, NJ, NY). Key sectors include ed‑tech, healthcare IT, fintech, marketing automation. It targets early to growth stages of firms with ~$1m‑$15m revenue, ~20%+ growth, making initial investments of ~$0.25m‑5m into businesses with enterprise values from ~$1m‑200m.

Quill Payments

-

Quill helps college town merchants attract and retain their ideal customers through past spending behaviors. Their student mobile app helps college students find the best deals and consolidates their loyalty rewards into one easy-to-use platform mapped to transactions made on their cards of choice.

-

Benji Damon, Amaya Malik, Varun Jhamvar, Lois Hong, Hoang Tran

-

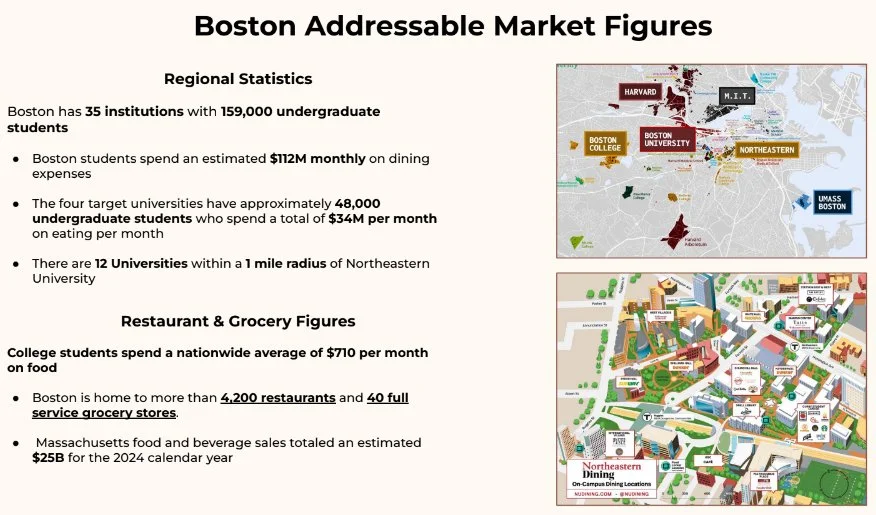

The Quill team was tasked with conducting comprehensive research into user dynamics for college students in the Boston college ecosystem to facilitate future market entry plans.

-

The Quill team presented comprehensive insights into Boston college students' spending habits and the college-town merchant-student ecosystem that Quill could tap into for potential expansion opportunities.

Kidogo Media

-

Kidogo is the operator of a multimedia edutainment company intended to curate videos and learning games. The company offers diverse, wholesome, educational, & accessible musical content that features & honors black culture for preschool-age children, enabling clients to make diverse, multicultural content available for all children.

-

Cameron Elder, Shashwat Khivasara, Saariya Faraz, Ananya Karthik, Fedor Bentsa, Siya Jairath

-

Kidogo needed assistance in focusing its Go-To-Market efforts as well as effectively modeling its financial situation over the next five years to confidently approach investors and enter the market with the necessary resources. We also pitched Kidogo to Northeastern's Impact Investing Fund for a seed-stage investment.

-

The Kidogo team i) offered an actionable outline of a school partnership market entry strategy, ii) conducted a SWOT analysis to help Kidogo identify its positioning effectively, and iii) recommended potential sponsors with custom suggested outreach to reach them. We also pitched Kidogo to Northeastern's Impact Investing Fund for a seed-stage investment in 2023.

Meaningful comparison of social media avenues to best improve LeaseClub’s brand presence

LeaseClub

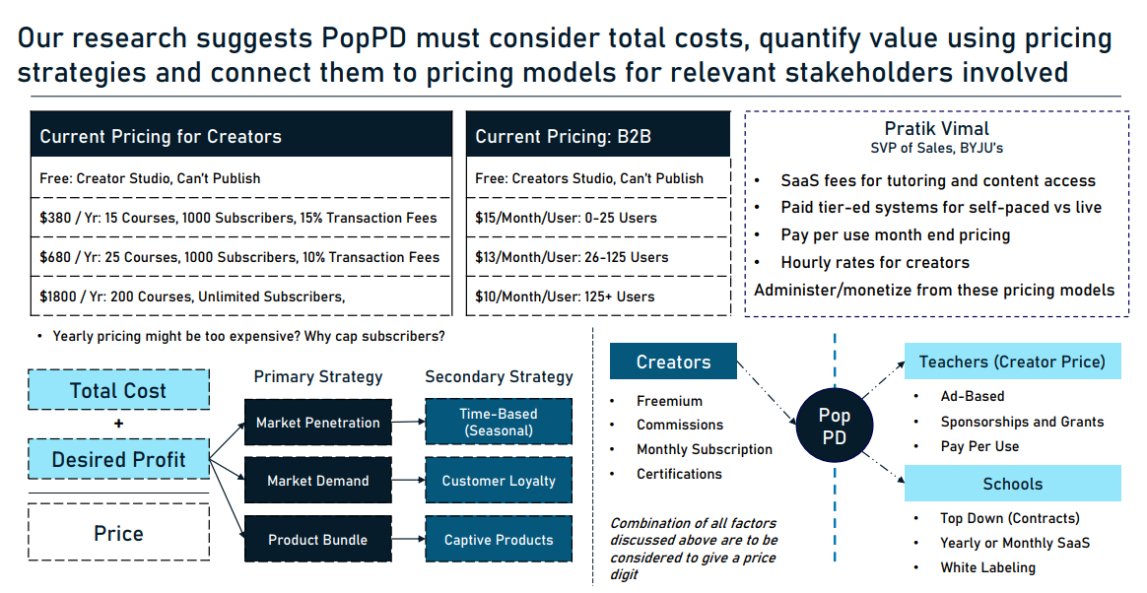

Thoughtful framework to inform PopPD’s pricing efforts suggested using expert interviews

CareX Ventures

-

Glasswing Ventures is an early‑stage venture firm headquartered in Boston, Massachusetts (USA). One early fund closed at about US$112 million and the broader AUM is less clearly publicized.

-

Glasswing backs AI‑native, frontier technology companies, particularly at seed to Series A, in enterprise software and cybersecurity. Their geography is U.S.‑centred, lead checks often modest (e.g., hundreds of thousands to low millions), focusing on deep tech where machine learning and automation power new business models.

PopPD

-

Backed by Techstars, PopPD is the developer of an online professional development platform designed to empower educators. The company's platform offers self-paced, on-demand courses, peer-to-peer collaboration, and coaching opportunities, enabling educators to continuously learn and grow.

-

Eshan Gupta, Chloe Conroy, Nick Perrotta, Saariya Faraz, Alex Yang, Shivam Singhal

-

PopPD needed assistance in pursuing extenstive exploration to determine best platform pricing strategy, gain insight into sales processes for K-12 schools, and get a clear understanding of market sizing and their unique positioning.

-

The PopPD team presented a comprehensive research of ~60 pages outlining i) key pricing strategies backed by academic theory and sample cases, ii) detailed school RFP processes with surveyed school principals to determine platform viability, and iii) comparative SWOT analysis of PopPD's competitors to suggest differentiation aspects to raise VC effectively.

-

LeaseClub was a PearVC-backed developer of a rental marketplace platform intended to leverage shared communities like schools to connect new renters to apartments through existing tenants. The company aimed to redefine the traditional apartment search experience, enabling users an access exclusive units earlier than other sites, avoid broker's fees, and unlock a better way to discover their ideal apartment.

-

Shivam Singhal, Alex Yang, Mei Wang, Stuart Mitcheltree, Keshav Warrier

-

The LeaseClub team was tasked with conducting a deep dive exploration into potential marketing and sales strategy to help LeaseClub effectively launch its product in Boston-based undergraduate colleges.

-

Our team conducted comprehensive research into key marketing strategies that could be leveraged by LeaseClub to effectively penetrate the Boston college market. Unfortunately, LeaseClub shut down mid-project.

Sample Deliverables

Focused comparison of Slate Milk and competitors to identify unique selling points

Primary Ventures

-

Primary Ventures is a New York City–based venture capital firm (386 Park Avenue South, New York, NY) that focuses on early‑stage tech companies. It has approximately $1.4 billion in assets under management.

-

Item descrPrimary invests at seed and early stages, primarily in the New York ecosystem, backing founders they consider exceptional across sectors (rather than a narrowly defined industry focus). They emphasize a high‑touch, founder‑first partnership and look for standout teams scaling into Series A.

Techrupt Innovations

Glasswing Ventures

-

Glasswing Ventures is an early‑stage venture firm headquartered in Boston, Massachusetts (USA). One early fund closed at about US$112 million and the broader AUM is less clearly publicized.

-

Glasswing backs AI‑native, frontier technology companies, particularly at seed to Series A, in enterprise software and cybersecurity. Their geography is U.S.‑centred, lead checks often modest (e.g., hundreds of thousands to low millions), focusing on deep tech where machine learning and automation power new business models.

Upfront Ventures

-

Upfront Ventures is headquartered in Santa Monica, California (USA) and has roughly US$2.3 billion in assets under management.

-

Upfront invests across early‑stage technology (seed and Series A), with a broad sector palette including SaaS, consumer, digital media, fintech, health‑tech and more. Geographically U.S.‑focused (with particular strength in Southern California) but also open nationally; typical check sizes at seed/Series A are in the low‑millions (≈US$0.5–15 m).

Moneta Ventures

-

Moneta Ventures is dual‑headquartered in Sacramento, California and Austin, Texas. It manages $360 million+ in AUM and has recently raised over US$250 million for its third fund.

-

Moneta focuses on “Software++” – enterprise software companies with transformational technology and multi‑layered monetization strategies. They invest at seed and Series A, primarily in U.S. West Coast and Texas, with check sizes around US$1–5 million for initial rounds.